- Intro

- Chart

- The Language of Holding Trades

- The Language of No-Personal

- Judging Performance Without Personal

- Give Each Trade a Personality

- Failure Conditions Lead to Better Management

- Visualising Helps Retrain Our Craft

- Summary

Intro

Today’s post comes from a friend who asked me to review his trades.

It takes courage to do this.

I don’t like doing it, but I’ve trained myself to do it anyway.

I have used the information to structure a formal post. It has recommendations and lacks anything personal from him. But a special thank you to him for sharing!

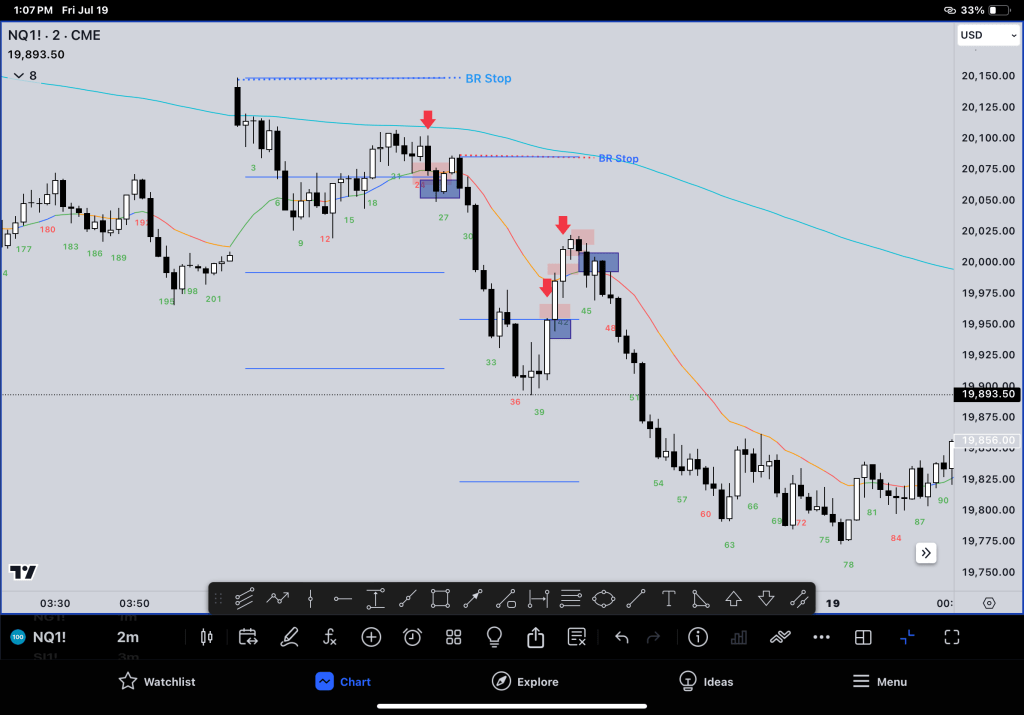

Chart

– Minimal is best

– Entry, exit and stop

– I added arrows because some had multiple entries

The Language of Holding Trades

Firstly, we never hold a trade.

The trade starts with a click of a button as a position, long or short, and we watch the point count go up and down over time.

Eventually, we decide to click a button, and the trade has ended.

Holding is usually stressful. We come into the world holding nothing, and we leave holding nothing. Between, we like to hold things.

It’s also stressful because we have to let go before we can hold something else. So by definition, when we hold, we’re not free.

Practice: Try changing your language.

Look at trading as expressing ideas, or opinions about the market.

Think and talk about your trades without using the word hold. You will feel more free. Whether in or out of a trade.

The Language of No-Personal

Let’s take the above step a little deeper.

Words come from our thinking. Analyzing our words reveals the patterns of our thought processes.

Hold isn’t the only personal word we use! I try to reduce any personal words I can when thinking about my trading craft or performance.

It has helped me reduce my stress and think more objectively.

I believe that supports the conditioning needed to take good trades.

It’s a foundation.

For example, rather than using “win” or “loss”, consider being in sync or out of sync (not right or wrong).

I am intentional with my own speaking to use words that align with my values about the market.

Practice: Observe the words you use to describe yourself, your trades and the market and see how much personal judgement is in there.

Try to practice without it and feel the difference.

Judging Performance Without Personal

But how do I judge my own trades?

I objectively look at 4 components:

– the entry

– scale-in (I’m out of sync)

– add-on (I’m in sync)

– exit.

For example

– Was my exit a reasonable opposite trade?

– Was the action to the information strong or weak? A strong entry is one that is still good the next day.

– Was the entry / exit price exactly correct or did I miss?

– What was the return compared to the initial risk and actual risk?

(Notice I didn’t look at whether it was a win or loss at all.)

Practice: Use the above headings as a way to review your trades each day and see what you can learn.

Imagine you are looking at the trades of another trader and write down what you would say to them.

I still use this practice every day because it helps me continue to get better.

Give Each Trade a Personality

I was bad at trading for many reasons. I kept turning this trade into a new one until I lost money.

A trade always started but never had a clear finish.

So I learned to give each trade a ‘personality’ of sorts.

For example, in a bear channel, a second-entry short is a two-legged pullback trade. It is a trade that continues the trend.

It should continue the trend! It should make a new low. You can take some off there, or not, or add or exit completely.

Practice: Give your setups personalities and get to know them better. Start a fresh document and write the title. Now screenshot 100 of those trades. Come back the next day and look over them. Start to group them:

– Win vs loss

– Strong vs weak

– Trend vs Countertrend etc.

Come back the next day and look over the groups. Patterns will emerge.

– How many bars did it take to work?

– How deep was the pullback?

– How many legs?

Failure Conditions Lead to Better Management

Continuing the above lets take that second-entry short in a bear channel.

This ‘trade personality’ now has a CLEAR failure condition. And therefore a clear way to manage it.

If that trade does not make a new low you don’t rename it!

Practice: Using the setup from before or your own, find examples of when it has definitely FAILED.

Now go back a few bars and look for evidence leading up to.

Ask yourself if you could have seen that failure one bar earlier, two bars? Maybe it was a big surprise and that was it. Did you act immediately to exit the trade? Why or why not?

Visualising Helps Retrain Our Craft

When holding trades is the subject, many traders will say RR.

But closing trades early is not just technical. I think it is equally or more emotional.

We have started the work above so let’s train the emotional response.

Emotional responses are either trained or untrained.

Professional sportspeople, military personnel, high-risk jobs all train emotional responses.

When I was losing every day and every trade, I was scared to let any profit go. Close.

I scaled in heavily to a leg 3 failure because I couldn’t take another loss. Didn’t close.

Then the scale in starts working, at a heavy size – let it run? No. Close.

Reading a book about sports psychology I read about visualisation.

Practice: Sit quietly and comfortably somewhere where you can take a few deep breaths and close your eyes for a few minutes.

Imagine in great detail sitting at your workspace placing that trade. Hear the click, feel your bum on the seat and your feet on the floor. Feel your own breathing. Then imagine you are watching it go against you.

First a few points, then a whole bar range and then move towards your stop. Very slowly you might feel your chest tighten, your thinking increases as the primal-brain “should do” list rises. When I first practiced this I sighed out loud!

It makes me laugh. An imagined trade made me physically sigh in the present! Hilarious.

It was a sigh of relief? No… nasty self talk.

– “Not again idiot”

– “You shouldn’t have done that.”

– “You know better”

– “You’ll never become a good trader”

(I’ll stop my self-talk there because it was so, so mean!)

You would never talk to your friend like that.

I had to practice daily at least 5 – 10 mins of watching trades go against me / for me and practice staying totally calm. I would repeat this throughout the day.

If you have done the step before (give trades a personality) then it is easier to know what to expect.

It is harder than you ‘think’ at first. You think the feelings until you really feel them.

The more detail from the senses you can add the better the effect.

Summary

I hope that gives you some new ideas to pursue in improving your trading!

Leave a reply to Tim Fairweather Cancel reply