-

Continue reading →: From Idea to Edge: One Trader’s Process for Setup Research

Continue reading →: From Idea to Edge: One Trader’s Process for Setup ResearchIntroduction I often get asked how I research different setups. I’ve never actually written out my process before—this is my first go. What I’ve shared below is just one way I approach it. It’s not the only way, but it’s helped me turn ideas into something more concrete. I’m not…

-

Continue reading →: Trading in Trading Ranges: 1/2R -> 1R

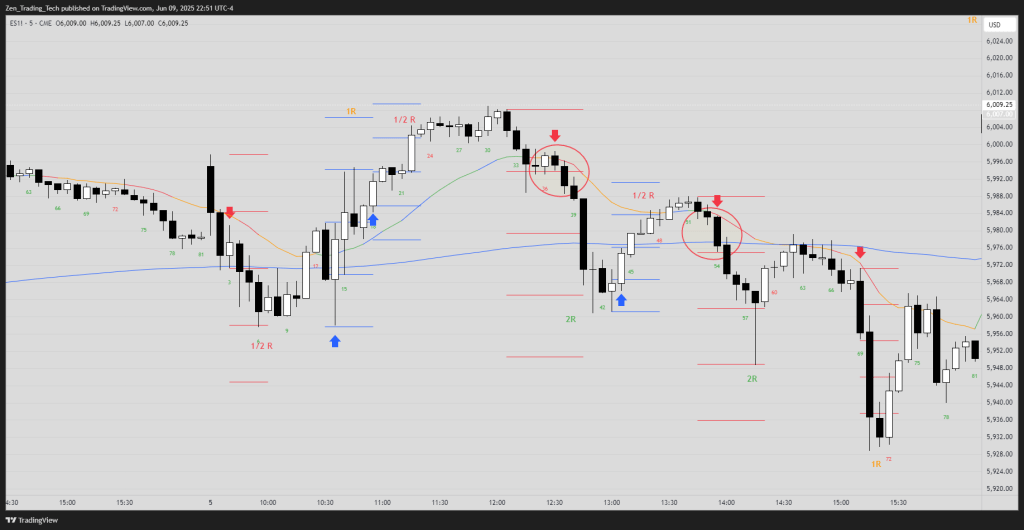

Continue reading →: Trading in Trading Ranges: 1/2R -> 1RIntroduction Main Idea Chart Example 1 Chart Example 2 Chart Example 3 Summary

-

Continue reading →: 🧠 Study Trade Failures: Obsess Over Exits

Continue reading →: 🧠 Study Trade Failures: Obsess Over ExitsMost traders focus on where to get in. Few study where a setup breaks. This post walks through a wedge example and shows why knowing what shouldn’t happen is just as important as knowing what should. The real edge? Spotting failure early and cutting with precision.

-

Continue reading →: 📊 The #1 Trading Mistake: Confusing Setup with Signal

Continue reading →: 📊 The #1 Trading Mistake: Confusing Setup with SignalLet me make it simple: In my reviews with hundreds of traders, there’s one mistake I see more than almost any other.It’s subtle, but it sabotages your entries, messes with your stop placement, and creates hesitation in the moment. 👉 The mistake? Confusing a trade setup with a trade signal.…

-

Continue reading →: 🎯 Same Trade, Two Outcomes – What That Really Means

Continue reading →: 🎯 Same Trade, Two Outcomes – What That Really MeansEvery trader eventually faces this moment:“I took the same setup two days in a row. One worked. One didn’t. What did I do wrong?” A trader recently sent me this exact question after trading two microchannels—one long, one short—with completely different outcomes. It’s a great question because it cuts to…

-

Continue reading →: Brooks Trading Course – European Trading Room Trial

✅ Webinar Links Start 30 mins before Frankfurt Open (8:30am CET European Time). Run for 3 hours. 20th May, 2025 https://attendee.gotowebinar.com/register/7210129310403638871 22th May, 2025 https://attendee.gotowebinar.com/register/6620457925892506454 🎯 Outcomes Help traders: FTSE 100 vs DAX 40 – Cash Index and Futures Comparison (May 2025, Central European Time) *I’ve done my best to…

-

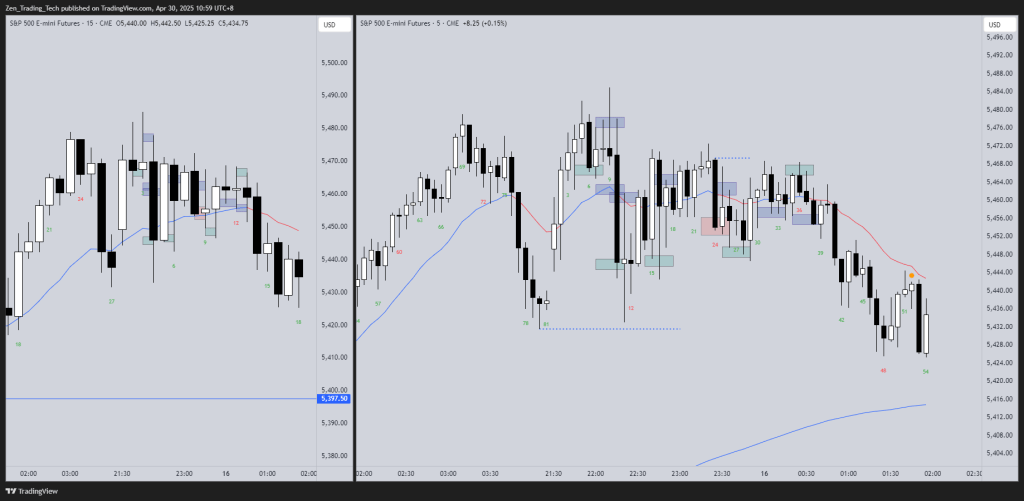

Continue reading →: How to Use 15-Min Charts to Confirm 5-Min Trade Setups: Trade Review Drill

Continue reading →: How to Use 15-Min Charts to Confirm 5-Min Trade Setups: Trade Review DrillTraders can enhance their strategies by using both 5-minute and 15-minute charts. Reviewing trades on the longer timeframe helps identify alignment with market structure and avoid mistakes. It encourages better timing and decision-making, reducing confusion. Practicing this routinely fosters improved trade execution and greater awareness of market dynamics.

-

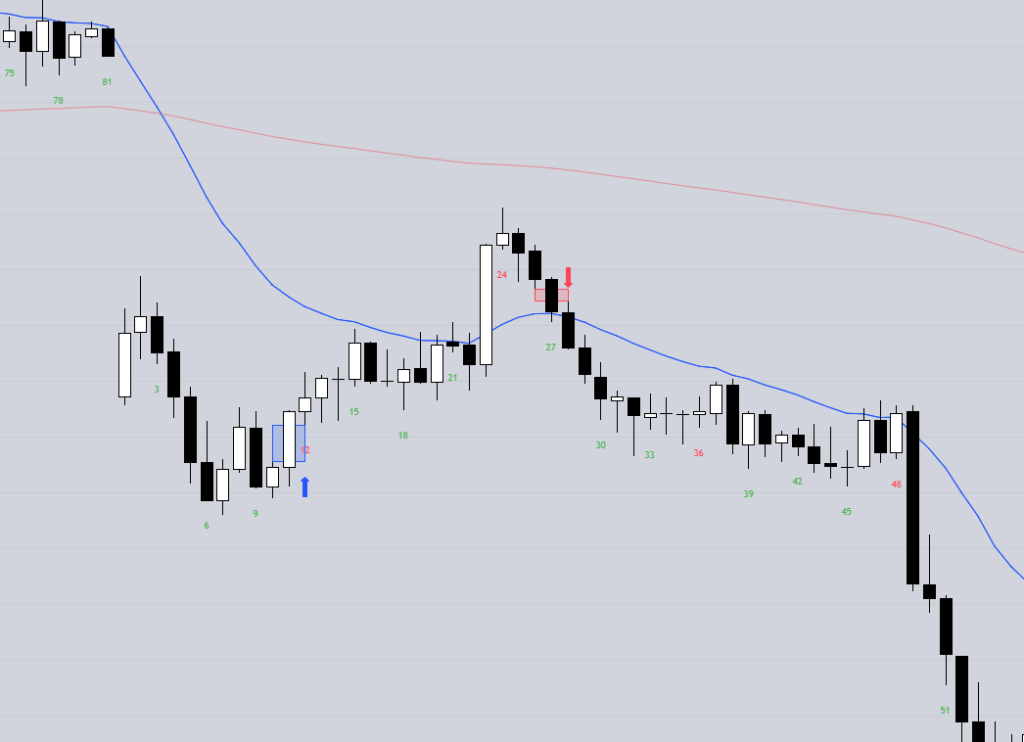

Continue reading →: 📈 1:1 Review Drill: Are You Always on the Wrong Side?

Continue reading →: 📈 1:1 Review Drill: Are You Always on the Wrong Side?Here is a simple way to sharpen your entries:Split the range into halves and review your trades. Ask yourself: 🛠️ Exercises to Practice 🔹 Exercise 1: Find a 1R Exit Focus on small wins first — you’ll clean up a ton of mistakes just by making sure you’re taking trades…

-

Continue reading →: Micro-Gap Reversal– Youtube Video is up!

Continue reading →: Micro-Gap Reversal– Youtube Video is up!I did a short video on ways you can use the indicator here. We’ve have a few great setups using this already this week. Hope it inspires you to research PA further. Cheers, Tim Original Post: Link to the indicator Zen MIG Reversal V1 on TradingView Note: This is not…

-

Continue reading →: The Micro-Gap Reversal– A Simple and High Probability Pattern

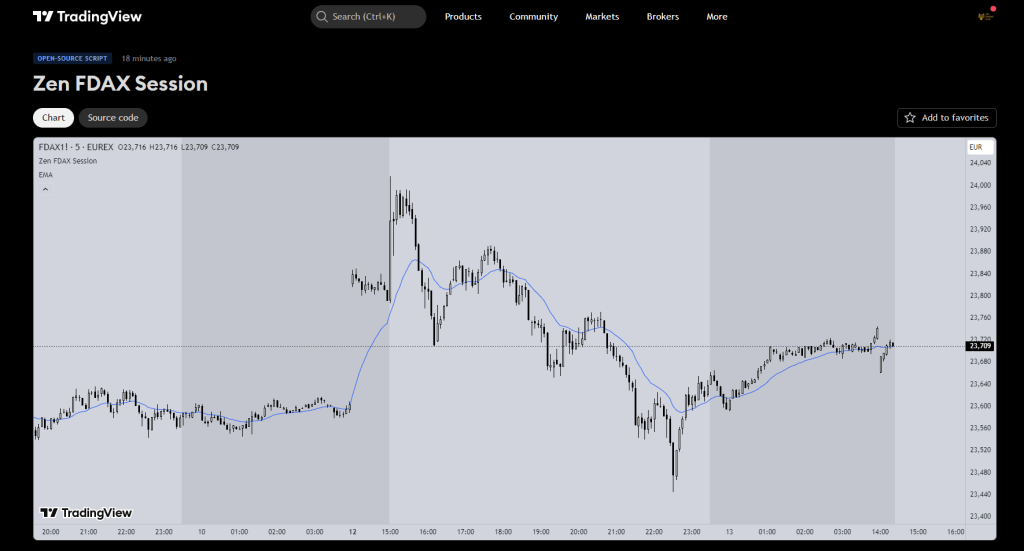

Continue reading →: The Micro-Gap Reversal– A Simple and High Probability PatternThis indicator is built to highlight a specific kind of 3-bar structure — something I’ve seen repeat after momentum gaps or aggressive moves. it is a micro-gap (gap between 3 same-colour bars) on the WRONG side of the moving average. Bears getting 3 consecutive bear bars ABOVE the MA? MIG…

-

Continue reading →: The First Three Bars: A Simple Tool for Deep Research

Continue reading →: The First Three Bars: A Simple Tool for Deep ResearchToday I’m sharing a new indicator I built for exactly that purpose. It’s called “3 CSC Bars”, and it does one thing only—but it does it well. It highlights the first three bars of the RTH session if they’re all bullish or all bearish. https://www.tradingview.com/script/exepFQlW-Open-CSC-Bars-3/ Why does that matter? Because…

-

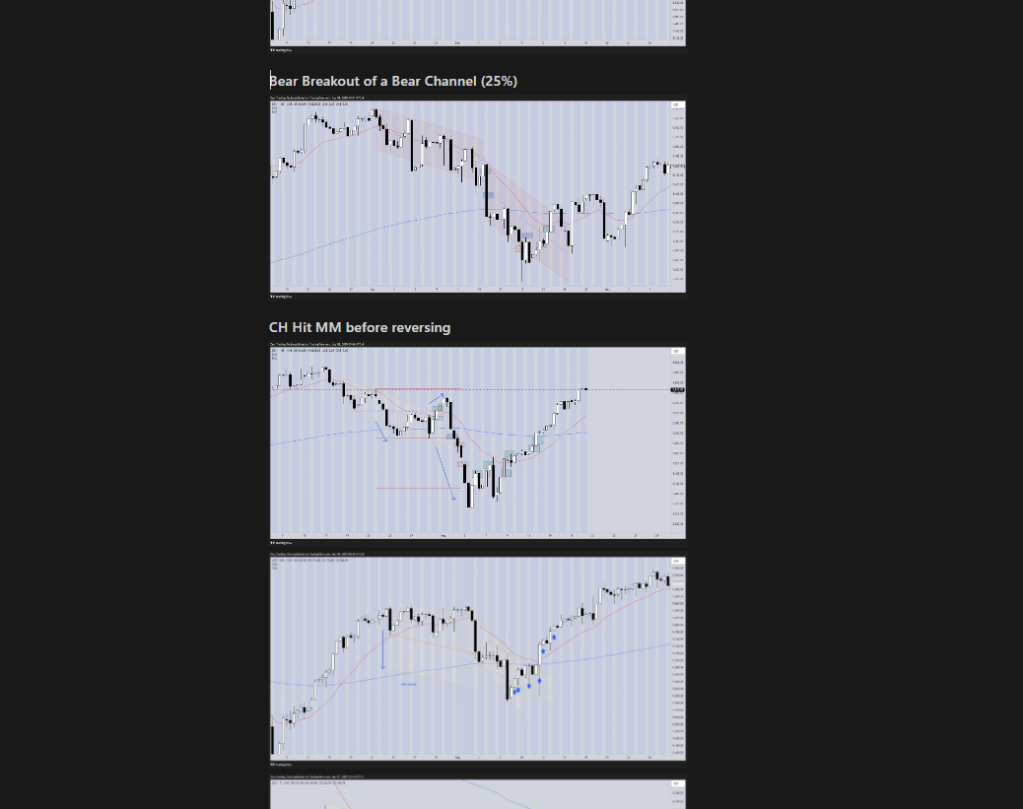

Continue reading →: 🧠 Build Your Own Trading Encyclopaedia – Part 1

Continue reading →: 🧠 Build Your Own Trading Encyclopaedia – Part 1Want to really understand a price action pattern? Don’t just memorize someone else’s notes—rebuild them yourself.This post shows you how I do it, using “Channel Failures” as the example. Below the post I include my notes for you to kick off from. 📚 The Exercise The goal is simple:Take a…

-

Continue reading →: Build Your Edge Before the Market Opens: Why I Use Flashcards to Train

Continue reading →: Build Your Edge Before the Market Opens: Why I Use Flashcards to TrainMost traders think their edge is in their strategy. But the deeper I’ve gone into this game, the more I’ve realized: My real edge is repetition. Pattern recognition. Conditioning. Preparation. What are my repeated weak behaviours in trading and how I can improve on them to become better. Let me…

-

Continue reading →: Effective Trading Strategies: Unlocking the Power of Shaved Bars

Continue reading →: Effective Trading Strategies: Unlocking the Power of Shaved BarsIntroduction to Shaved Bars A shaved bar is a bull bar with no or minimal lower tail (less than 10% of the total bar size) or a bear bar with no or minimal upper tail (less than 10% of the total bar size). This indicator places an arrow below a…

-

Continue reading →: Mastering Urgency in Trading with Shaved Bar Indicator

Continue reading →: Mastering Urgency in Trading with Shaved Bar IndicatorIn fast-moving markets, timing is everything. One of the most powerful signals is the shaved bar: a bullish candle with no lower tail or a bearish candle with no upper tail. These bars show no overlap with prior candles, signaling clear intent and momentum. Update – go here for the…

-

Continue reading →: Trading Price Action in Motion: Watch These ES Futures Trades Play Out!

Continue reading →: Trading Price Action in Motion: Watch These ES Futures Trades Play Out!In this video, I present a market replay showcasing both the trades I took and the ones I skipped or missed — all focused on Al Brooks-style price action entries. I also replayed different ways to trade the same setups. 🛑 No voice commentary — just clear, fast-paced trade replay…

-

Continue reading →: 10 Powerful Strategies for Trading Channels

Continue reading →: 10 Powerful Strategies for Trading ChannelsIntroduction In this post, I’m going to talk about entering tight channels. I’ll review a variety of different ways we can approach a tight channel, with the goal of helping you develop a method that suits you. For a long time, I struggled to enter tight channels, often looking back…

-

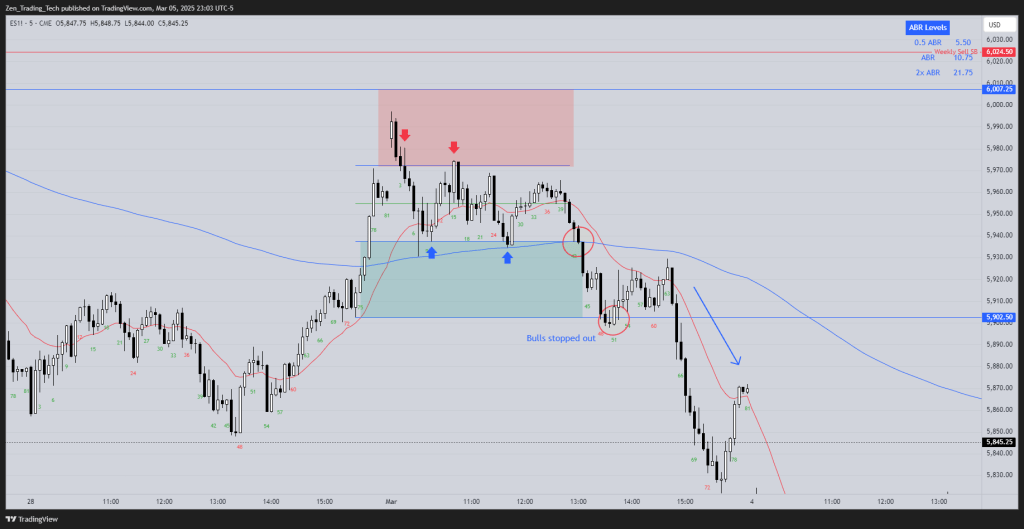

Continue reading →: Mastering Scalping with ABR Levels – A Simple Risk Management Tool

Continue reading →: Mastering Scalping with ABR Levels – A Simple Risk Management ToolScalping is all about precision and timing. And one of the biggest mistakes traders make? Ignoring volatility. That’s where ABR Levels (Average Bar Range Levels) come in – a simple but powerful tool to help you scale your trades dynamically and avoid unnecessary losses. What Are ABR Levels? ABR Levels…

-

Continue reading →: Zen R Targets – The Ultimate 2R Calculation Tool for Traders

Continue reading →: Zen R Targets – The Ultimate 2R Calculation Tool for TradersPlanning trades with clear risk-reward targets is essential for professional traders. The Zen R Targets indicator simplifies this process by automatically calculating 2R profit targets based on your preferred entry method—either a Stop Entry or a Close Entry. Whether you’re a price action trader following Al Brooks methodology or a…

-

Continue reading →: Trading in a Trading Range: Hot Zones and Stop Hunting

Continue reading →: Trading in a Trading Range: Hot Zones and Stop HuntingTrading in a range can be frustrating—until you learn to see the hot zones where traders are making their moves. I will stay take losses. But I have a better chance of not getting in repeated reversals which will take my profit away from my prior good trades! After studying…

-

Continue reading →: How to Reset Your Trading Mindset

Continue reading →: How to Reset Your Trading MindsetKey Takeaways Introduction In this post I will discuss a trading day that went from bad to good to bad to good again. I will discuss strategies for observing and changing our mindset to be more in sync with both the market and our internal centre. My intention it to…

-

Continue reading →: The Power of Homework to Improve Your Trading: Next Day Repeat

Continue reading →: The Power of Homework to Improve Your Trading: Next Day RepeatEvery trading day provides a roadmap for the next. The market isn’t random—it follows repeatable patterns, and the traders who study them are the ones best prepared to take advantage when they appear again. By reviewing today’s price action, you build a playbook for tomorrow. The same setups happened again…

-

Continue reading →: The Magnificent Seven Trading Drills – Sharpen Your Price Action Skills

Continue reading →: The Magnificent Seven Trading Drills – Sharpen Your Price Action SkillsJust like in the classic Western The Magnificent Seven, where each gunfighter had their own style, every price action trader must master different drills to survive the daily shootout of the markets. These seven trading drills will train your instincts, helping you recognize high-probability setups and avoid getting ambushed by…

-

Continue reading →: The Live Gap Indicator: Seeing the Market’s Magnetic Forces in Real-Time

Continue reading →: The Live Gap Indicator: Seeing the Market’s Magnetic Forces in Real-TimeGaps are magnets. If you’ve been trading price action long enough—especially using Al Brooks’ methodology—you know that open gaps act like unfinished business for the market. They pull price back, either to close completely or to act as support/resistance. But how do you track these gaps efficiently without cluttering your…

-

Continue reading →: How to Become a Better Swing Trader

Continue reading →: How to Become a Better Swing TraderVideo: Example 1 Example 2 Example 3 Time for your to practice

-

Continue reading →: Simple Process for Determining Context When Trading Price Action

Understanding market context is key to price action trading. Using Al Brooks’ methodology, here’s my structured approach: Quick Summary This streamlined approach ensures I analyse price action effectively, aligning trades with the market’s context. By refining this process, I improve decision-making and trade execution.

-

Continue reading →: Trading With Active Patience: How to Change Your Emotions Through Action

Continue reading →: Trading With Active Patience: How to Change Your Emotions Through ActionI was reflecting on one of my favourite Zig Ziglar quotes: Logic can’t change emotion, but action will. That quote stuck with me. It made me wonder—how does this apply to trading? Fixing a Deep-Seated Trading Problem For years, I struggled with scaling into losing trades—until I found a way…

-

Continue reading →: The Trader’s Equation: How Stops and Exits Shape Your Edge

Continue reading →: The Trader’s Equation: How Stops and Exits Shape Your EdgeIn this post, I’m exploring the trader’s equation and how our exits and stop locations fundamentally change our trading mathematics. These changes can explain why traders slowly blow accounts without even realizing it. My own trading experience, combined with reviewing countless other traders’ decisions, has shown this pattern repeatedly. This…

Hi,

I’m Tim

Welcome to Zen Trading Tech.

I’m a Aussie day trader and I post trading tips, practice drills, and indicators that helped my trading get to a professional level.

Everything here is to help train the eyes and hands to trade better. If it helped me I’ll post it for others. Hope you enjoy!

Join the fun!

Stay updated with our latest tutorials and ideas by joining our newsletter.