-

Continue reading →: Unlock Powerful Insights With a New Indicator: Open on High, Open on Low

Link https://www.tradingview.com/script/uIYwKaA8-Open-on-High-Open-on-Low/ At Zen Trading Tech, we’re all about simplifying complex trading concepts into easy-to-use tools that help traders spot key opportunities. Our latest TradingView indicator, Zen O=L O=H v1, does just that by visually highlighting important price action moments when a bar’s open equals its high or low. What…

-

Continue reading →: ⚡ 5 Dynamic Trading Strategies – Which Will Win the Day?

Continue reading →: ⚡ 5 Dynamic Trading Strategies – Which Will Win the Day?Intro Video Chart https://www.tradingview.com/x/AkcaD7tV/ Strategy 1: Buy the Close Instructions Performance *I made a mistake with tthe first exit, the trailing stop took me out – but I kept playing (It happens in live trading anyway.) So first loss was larger. Strategy 2: Buy the Close, and Buy Below Instructions…

-

Continue reading →: Mastering Spike and Channels – 5 Key Practice Drills (Spikes Part III)

Continue reading →: Mastering Spike and Channels – 5 Key Practice Drills (Spikes Part III)Index In This Post: Why Read About Spikes and Channels? Where Did We Get to Last Time Video Spike and Channel Introduction Why Is This Important? Different Trade Management for Difference Parts of the Cycle Drill #1: Finding Spike and Channels Step 1: Mark Up Spikes Step 2: Mark Up…

-

Continue reading →: Unlock Swing Trade Potential with 60-Minute Signal Bars

Continue reading →: Unlock Swing Trade Potential with 60-Minute Signal BarsWhat You’ll Learn in This Post In this blog post, I’m going to walk you through three key concepts: Intro Video Why do 60-Minute Signal Bars Matter? In a previous video, I talked about how you can use the 60-minute chart to guide swing trades on the 5-minute chart during…

-

Continue reading →: Improve Limit Order Trading with a Limit Order Entry Indicator

Continue reading →: Improve Limit Order Trading with a Limit Order Entry IndicatorIntro Indicator 1: Instructions https://www.tradingview.com/script/WMHrNPU8-Zen-LMT-Entry-v1/ Video Key Features: Comparing Stop Orders and Limit Orders

-

Continue reading →: Essential Trading Skills: Using Spikes and Stop-Order Entries

Continue reading →: Essential Trading Skills: Using Spikes and Stop-Order EntriesIntroduction Video Prior Reading Video 1 Consecutive bars and the stop-order trade When they fail they often become test targets Countertrend again! Conclusion

-

Continue reading →: Mastering Time Frame Analysis in Trading: HTF -> LTF (Part 2)

Continue reading →: Mastering Time Frame Analysis in Trading: HTF -> LTF (Part 2)Intro Video Links Link to first post: Effective Trading Techniques: Higher vs. Lower Time Frames (Part 1) Link to first video: Drill Instructions: Instructions Examples Monthly -> Weekly Weekly -> Daily Daily-> 60m 60m-> 15m 15m-> 5m Conclusion

-

Continue reading →: Effective Trading Techniques: Higher vs. Lower Time Frames (Part 1)

Continue reading →: Effective Trading Techniques: Higher vs. Lower Time Frames (Part 1)Intro Video Dr Al Brooks Trading Course Slides Drill Instructions: Instructions Examples What to do? What to do? Bull Examples HTF BL MC → LTF BL SPBT HTF BL SPBT → LTF BL CH HTF BL CH → LTF BL BRDCH HTF BL BRDCH → LTF TR Conclusion

-

Continue reading →: Zen ABR Target – Precision Scalping Indicator with Average Bar Range

Continue reading →: Zen ABR Target – Precision Scalping Indicator with Average Bar RangeIntro If you’re looking to improve your scalping strategy, the Zen ABR Target is the perfect tool. Designed for TradingView, this indicator uses the Average Bar Range (ABR) to assess if the next bar meets the target, helping you gauge market momentum and identify potential trading ranges. The indicator shows…

-

Continue reading →: Master Scalping with Zen Bar Range: A Powerful Free Indicator for TradingView

Continue reading →: Master Scalping with Zen Bar Range: A Powerful Free Indicator for TradingViewLink https://www.tradingview.com/script/vOumw4w0-Zen-Bar-Range-v1/ Video Intro In the fast-paced world of trading, scalpers thrive on precision, speed, and the ability to capture small price movements for consistent gains. But how do you ensure that you’re entering and exiting trades at the right moments? Enter the Zen Bar Range indicator—your new best friend…

-

Continue reading →: Stop-Order Entries

Continue reading →: Stop-Order EntriesIntro Video Indicator Instructions Drill 1: Find the entries Instructions Drill 2: Look at different market structures Drill 3: Add in the swing stops Instructions Here are possible places for it on the way down and upDrill 3: Add in the swing stops until it is broken The swing stop…

-

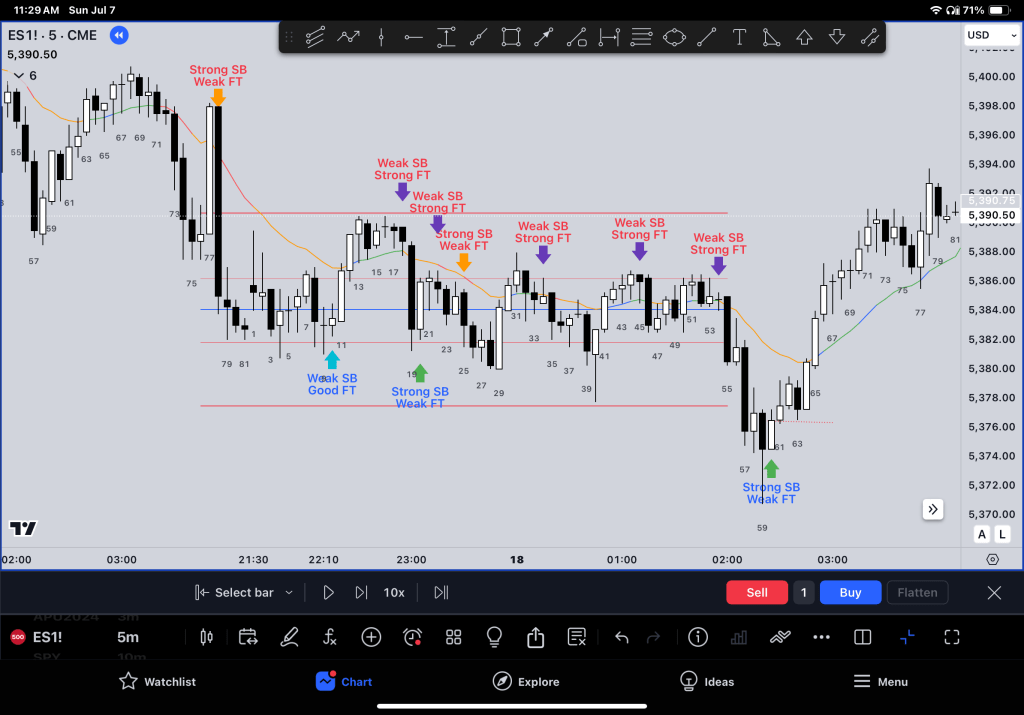

Continue reading →: How to Identify Spike Patterns in Trading

Continue reading →: How to Identify Spike Patterns in TradingVideo I made a video here: Indicator Click here to find it Spikes 3 CSC bars indicator 1. Mark Up 3 Consecutive Bars 2. How Often do they have 2nd legs? So now you can see how good important it is to trade in the direction of the spike The…

-

Continue reading →: Unlock Breakout Potential with an Indicator for Stop Order Entries

Intro Indicator Key Features: How to Use:

-

Continue reading →: Mastering Trendline Breaks for Effective Trading

Intro Video Drill 1: Trendlines – Break- Test or not? Instructions Drill 2: Trendline Break, New High, Reversal Instructions Drill 3: Trendline Break on the Open Instructions Drill 4: Moving Average Break Instructions Conclusion

-

Continue reading →: How To Use Al Brooks Encyclopedia

Continue reading →: How To Use Al Brooks EncyclopediaIntro Video Check out the video here! Finish The course Get an Index! Each Pattern is a Failed Opposite Pattern https://www.tradingview.com/x/8BcYpLxE/ Are you looking for a pattern or a whole day? Use it on the open Most Common Slides Conclusion

-

Continue reading →: Trading Skills #31: Breakout H1 / L1

Summary Video Link Drill 1: Find H1 / L1 (Stop Entry) Instructions Drill 2: Find Weak H1 / L1 Instructions Drill 3: Going below a H1 / above a L1 Next Video

-

Continue reading →: Trader Skills #30: Wedges – 3 Push Patterns

Intro Video Leg Counting: 3 Ways Instructions for Drill: Various Other Notes on Wedges Conclusion

-

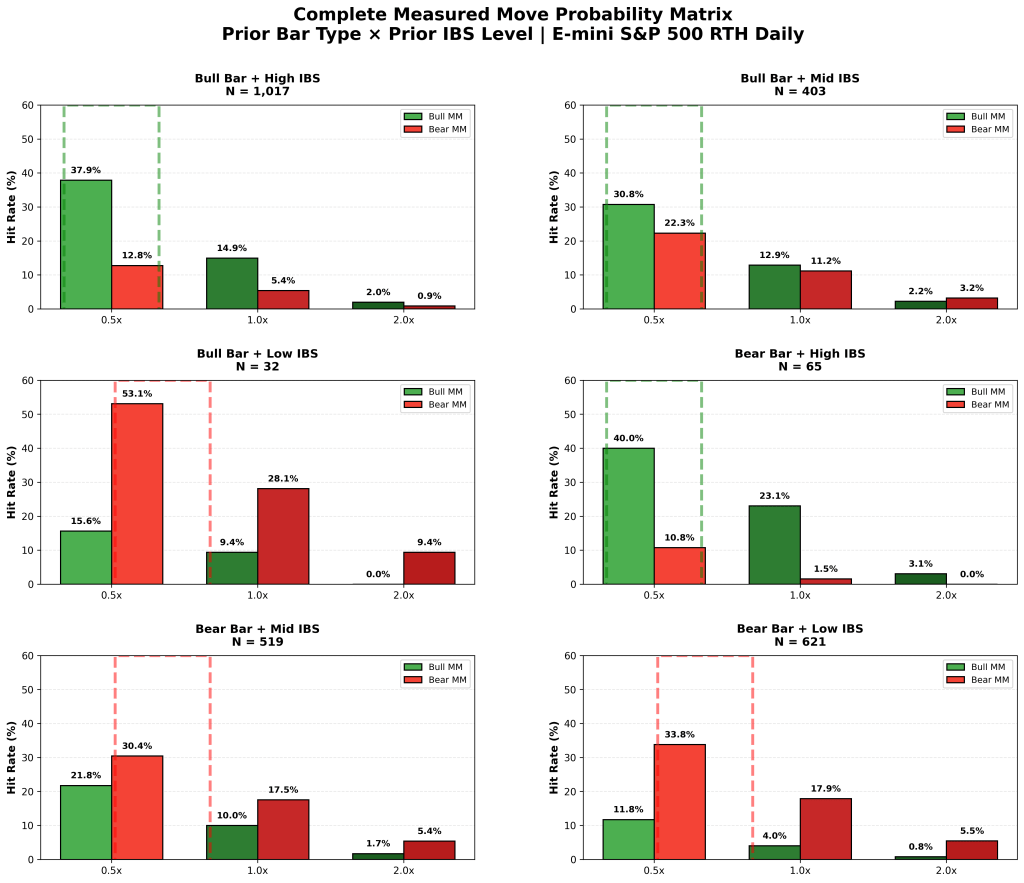

Continue reading →: Trader Skills #28: Is YD a Good Signal Bar?

Premise This explains how we can use the DAILY chart to help us find swing setups on the open and the rest of the day. Video I made a video below with many examples The 6 Decisions Towards the end of the bar, traders are finalising 6 decisions. These decisions…

-

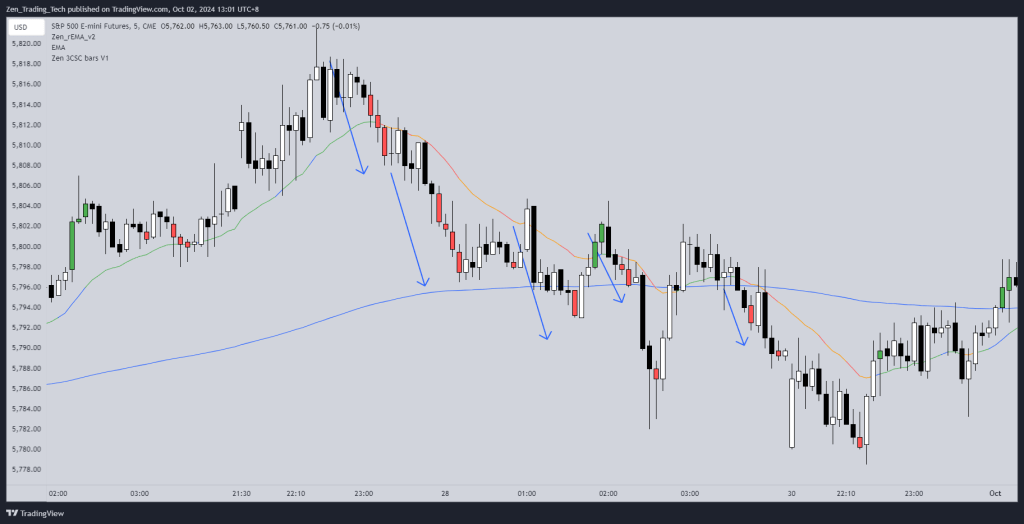

Continue reading →: Trader Skills #27: 60m Bars – What did traders do?

Video Intro Welcome to the exciting world of ES price action trading! If you’re like me, you’re always on the lookout for new ways to up your trading game. One trick I’ve found incredibly useful is using 60-minute bars to guide my trades on the 5-minute chart. It might sound…

-

Continue reading →: Trading The Open: Open in YD range?

Concept Video Research Open in YD Range https://www.tradingview.com/x/15IExX57/ Open in YD Range – YD Channel Open outside YD Range – Breakout Open outside YD Range – Sucked back in The Daily Chart Conclusions

-

Continue reading →: Indicator: Breakout and FT: Close > Prior High

Continue reading →: Indicator: Breakout and FT: Close > Prior HighVideo Intro This indicator is to TRAIN the eyes to follow the direction of the strongest breakout and followthrough. It is also a good indicator or market structure: The Zen Breakout and Follow-through indicator is designed to identify and highlight price action relationships using simple, clear visual signals. Use this…

-

Continue reading →: Trader Skills #26 : Leg Counting

Continue reading →: Trader Skills #26 : Leg CountingIntro In price action trading we look at relationships. As price moves in pulses / waves we look at their relationships to each other and what came before it. In the hope to profit from what comes after it. Counting these helps improves our price action reading skill. This can…

-

Continue reading →: Practice Drills #2

Todays research ideas I reviewed: 1. Tight channel, break trend-line, new low, reversal 2. Which side is controlling price and time more clearly? 3. Have those limit order traders got a profit targets to justify their risk? 4. Pullback = actual risk => target 1 – 2x aRisk 5. Traders…

-

Continue reading →: Practice Drills #1:

New style of post. I research other traders I like and take notes. I watch webinar recordings, read their books, videos, whatever I can find. Then I use those notes as my homework for the day. So for each item I will do a certain # of charts or #…

-

Continue reading →: Letting Go

Intro One of the great things about trading is that it is constantly teaching me to let go. I cannot control the outcome no matter what. I can control the process. I can select a reasonable entry. I can select the correct stop. I can select as appropriate target based…

-

Continue reading →: Trading Skills #25: 60m targets on the Open

I’m hoping this little piece on 60m targets from the ETH and RTH into the open will help you swing for the fences! ETH 60m session top left RTH 60m session bottom left Little lines on the 60m charts (Left) are 1R targets. By aligning myself with these targets I’m…

-

Continue reading →: Trader Skills #27: Emotional Training in Trading

Continue reading →: Trader Skills #27: Emotional Training in TradingIntro Today’s post comes from a friend who asked me to review his trades. It takes courage to do this. I don’t like doing it, but I’ve trained myself to do it anyway. I have used the information to structure a formal post. It has recommendations and lacks anything personal…

Hi,

I’m Tim

Welcome to Zen Trading Tech.

I’m a Aussie day trader and I post trading tips, practice drills, and indicators that helped my trading get to a professional level.

Everything here is to help train the eyes and hands to trade better. If it helped me I’ll post it for others. Hope you enjoy!

Join the fun!

Stay updated with our latest tutorials and ideas by joining our newsletter.